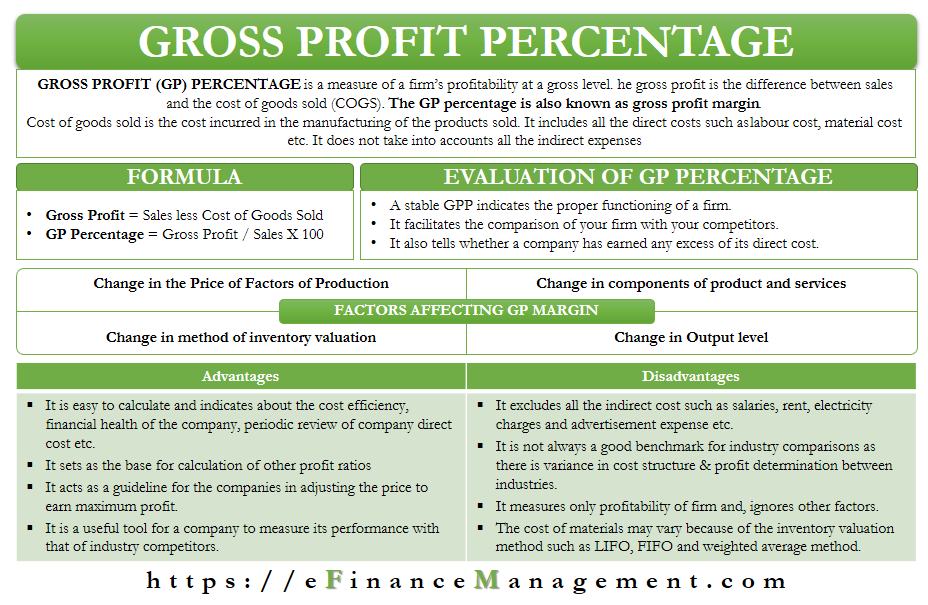

You can calculate profit margin using either gross profit (for gross profit margin) or net profit (for net profit margin).

You calculate net profit margin by dividing your net profit (so your revenue minus all expenses) by your starting revenue number. We'll use net profit margin as an example here.

You can calculate profit margin using either gross profit (revenue minus cost of goods sold), for gross profit margin, or net profit (revenue minus all expenses), for net profit margin. It answers the question: at the end of the day, how profitable is your business? Net profit margin is a ratio that essentially tells you how much of every revenue dollar is left after accounting for expenses. Wages for employees not involved in creating the product.Fixed costs are, like they sound, more stable and unlikely to change significantly over time. Utilities for the space where the product is createdįor ecommerce business owners who don't manufacture their own products, it's more simple: your variable expenses are just how much you pay to purchase the product you're selling.Depreciation of the equipment used to create the product.Wages for people who create the product.Variable expenses - also known as cost of goods sold - change based on the amount of product being made or sold and are incurred as a direct result of creating or acquiring the product. Net profit includes both fixed and variable expenses. That’s because your income statement can include a lot of non-cash expenses, such as depreciation and amortization. If $75,000 is allocated for salaries, $25,000 to operating expenses and $5,000 to taxes, those numbers are then subtracted from the gross profit, leaving a net income of $195,000. That leaves them with a gross profit of $300,000. Here's an example: An ecommerce company has $350,000 in revenue with a cost of goods sold of $50,000. Net Profit = Total Revenue - Total Expenses Since net profit equals total revenue after expenses, to calculate net profit, you just take your total revenue for a period of time and subtract your total expenses from that same time period. The calculation itself for net profit is fairly simple - it's just gathering all the data you need that can be tricky.

#Profit first percentages how to#

Want net profit to be automatically calculated for you? Visit our app listing! How to Calculate Net Profit: Growing businesses can use their net profit to save for future expenses, pay off debt, invest in new projects, products or staff, or distribute to investors. This indicates your business is expanding at a sustainable pace - and that growth can be expected in the future. The goal of successful online stores is to create a consistent net profit month after month. Net profit tells you your true bottom line - how much money you're actually left with at the end of the day. Net profitability is an important indicator for ecommerce and retail businesses to measure, since increases in revenue don't always translate to increased profitability. It’s also commonly referred to as net income. Net profit represents the money you have left over after expenses are paid. Calculating your company’s net profit is one of the best measures of business success and a key metric in ecommerce analytics.

0 kommentar(er)

0 kommentar(er)